Insights from Silicon Valley

Looking back on 2021

Summary

2021 was a year of three distinct phases. The action was in high growth companies, where sentiment fluctuated considerably over the course of the year. 2020 before it had been an astonishing year when many of these fast-growing companies had provided the tools for people to remain connected, allowing them to work and socialise.

2021 was a year of three distinct phases. The action was in high growth companies, where sentiment fluctuated considerably over the course of the year. 2020 before it had been an astonishing year when many of these fast-growing companies had provided the tools for people to remain connected, allowing them to work and socialise. However, these companies sold off hard in the first quarter of 2021 as the vaccine rollout allowed investors to contemplate economic recovery. People started to see the potential for higher interest rates and to look more closely attheir valuations.

However, in the Spring, the economy lost momentum and these stocks regained market leadership. They took on defensive properties, offering a source of growth in an environment where growth was difficult to generate. Coronavirus outbreaks forced further containment measures, pushing people back into the virtual world.

The growth stocks had a third act, sliding once again in the final quarter of the year as inflationary pressures mounted and investors started to fear higher interest rates. The Federal Reserve accelerated the withdrawal of its quantitative easing programme, while forecasts for interest rate rises in 2022 moved from one or two, to three or four.

Underneath all this share price volatility, many of these companies have seen strong business flows. Earnings have continued to outpace expectations. For the strongest companies, that has allowed their share prices to weather some compression in valuations. Valuations now appear more realistic moving into 2022. The exception is for some of the biggest names – notably Meta, Microsoft and Alphabet. These ended the year notably more expensive than they started it, leaving them vulnerable even though their fundamentals have been strong.

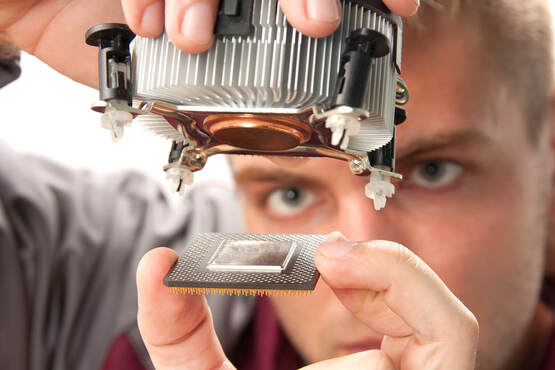

Areas such as semiconductors have seen the opposite trajectory on share prices. Shortages of components have been a feature of the year. Groups are bringing additional manufacturing capacity onstream, but it is a slow process. This helped product pricing and pushed share prices higher. However, at various points investors have asked whether this is as good as it gets and sold out, only to look at the structural growth case for semiconductors and reinvest.

The structural growth has, if anything, improved over the year, as areas such as electric cars raise demand for more complex chips. Revenue growth in the sector has accelerated and this is likely to endure. Demand could outstrip supply for the next three to four years. Semiconductors are having a resurgence and higher growth and valuations look well-founded.

The last group to join the party were the memory companies - Hynex, Microsoft and Samsung. Demand for PCs was slowing and prices were starting to weaken for memory. However, on balance, they did a little better than expected. They met slowing demand by ensuring they didn’t add capacity and there is a transition to a more secure chip to address security and power consumption issues. The current weakness on pricing could turn into a shortage in 2022, so those stocks have seena recovery.

Looking at 2022

In general, investors like companies that beat their previous year’s earnings, particularly if they do so by more than the market expects. Comparisons for some sectors within technology are getting more difficult. This is particularly notable among some of the FANG names (likes of Meta, Amazon, Netflix and Alphabet), where high expectations are colliding with, potentially, a softer advertising market. The consumer won’t have as many stimulus dollars to spend. At the same time, Apple’s changes on the privacy rules could make advertising less effective.

The digitalisation trend continued in earnest again in 2021 with many of the projects likely to last for several years. Digitalisation remains one of the main ways to address labour shortages, which appear likely to persist in 2022 and beyond. Areas such as hospitality, manufacturing, or supply chain management have little choice but to digitalise to ensure their long-term competitiveness. For cloud computing and cloud software companies, this means the fundamentals are as good as they have ever been. Many are highly valued, certainly, but these valuations appear justified given the potential growth.

Cyber security will continue to be an issue. There have been huge ransomware attacks in 2021, reminding companies of their vulnerability. Management teams realise they need to address the problem or face real threats to their ability to do business. Attackers continue to adapt and companies also need to adapt.

The China problem

Technology companies doing business in China have always had to tread carefully. The Chinese government showed its teeth in 2021, with clampdowns on the use of data and algorithms, plus other companies seen as doing social harm. Even the mighty Apple has not been immune – the SEC (U.S. Securities and Exchange Commission) rejected its petition to block three shareholder proposals from goingto a vote at the next annual general meeting. Two of them concern its operationsin China.

Apple makes all its products in China. China is also a significant source of revenue, so it doesn’t have the option – as many other companies have done – to bring product manufacturing closer to home. The Apple factories employ millions of Chinese workers and the Chinese government would take a dim view of any attempts to close them. It has to be very careful about what it does and says as a result.

However, it’s not the only one forced to defend its relationship with China. Amazon also found itself under scrutiny after it was forced to remove negative reviews of a book with collected speeches and writings by the Chinese premier Xi Jinping’s on orders From Beijing. Doing business in China comes with a price and even the US’s largest companies must play ball.

A tough year for ecommerce

Ecommerce didn’t hold onto the gains it made in 2020 as people escaped their homes and returned to stores. It had taken a big jump during the pandemic: it didn’t go backwards, but it didn’t gain any new advantage.

However, it is worth noting that the lines between ecommerce and ‘normal’ commerce are becoming increasingly blurred. Retailers are increasingly turning towards omnichannel options. Consumers can order online and pick up in store. Or they can go to a store, try things on and then have it shipped to their home. In general, retailers are becoming much more flexible in their approach. The new model of retail is yet to emerge, so they need to try different things and see which wins out with the customer. That’s part of the surge for the software industry – companies have had to employ software solutions to understand their customers better.

There are real winners among those who have done it well: some premium sportswear brands, for example, or some of the restaurant chains. If restaurants can manage it efficiently, they can increase the through-put of their kitchen and make a lot more money. In this way, the strong are getting strong. It’s great for the consumer, who is getting an experience far more closely tailored to their needs.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors may not get back the full amount invested. Competition among technology companies may result in aggressive pricing of their products and services, which may affect the profitability of the companies in which the Trust invests. In addition, because of the rapid pace of technological development, products or services developed by these companies may become rapidly obsolete or have relatively short product cycles. This may have the effect of making the Trust’s returns more volatile than the returns of a fund that does not invest in similarly related companies. Past performance is not a reliable indicator of future results. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer and/or its affiliated companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. A security mentioned as example above will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. This is a marketing communication issued by Allianz Global Investors GmbH, an investment company with limited liability incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42/44, D-60323 Frankfurt/M. Allianz Global Investors GmbH is registered with the local court of Frankfurt/M under HRB 9340 and is authorised and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Further information on Investor Rights are available here (www.regulatory.allianzgi.com). Allianz Global Investors GmbH has established a branch in the United Kingdom, Allianz Global Investors GmbH, UK branch, 199 Bishopsgate, London EC2M 3TY, www.allianzglobalinvestors.co.uk, deemed authorised and regulated by the Financial Conduct Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website (www.fca.org.uk). Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. Allianz Technology Trust PLC is incorporated in England and Wales. (Company registration no. 3117355). Registered Office: 199 Bishopsgate, London, EC2M 3TY.

AdMaster: 2046997

Video